When a major European automotive OEM recalled 50,000 vehicles due to PCB failures in their ADAS systems, the root cause wasn’t a design flaw—it was a supplier selection mistake. The chosen manufacturer lacked proper automotive certifications and couldn’t maintain the traceability standards required for safety-critical electronics. This $30 million lesson underscores a truth that design engineers and procurement managers know all too well: your automotive PCB supplier is more than a vendor—they’re a critical partner in your product’s reliability, safety, and market success.

In today’s automotive electronics landscape, where vehicles contain over 100 ECUs and more than 3,000 semiconductor chips, the stakes have never been higher. For OEMs and Tier 1 manufacturers developing electric vehicles, ADAS systems, and next-generation infotainment platforms, selecting the right PCB supplier isn’t just about competitive pricing—it’s about building a foundation for long-term reliability and regulatory compliance.

Understanding the OEM-Tier 1-Supplier Ecosystem

The automotive electronics supply chain operates through carefully orchestrated collaboration between OEMs, Tier 1 suppliers, and specialized manufacturers. OEMs like Tesla, Volkswagen, and Toyota define vehicle-level requirements and system architectures. Tier 1 suppliers like Bosch, Continental, and Denso develop complete subsystems—brake controllers, battery management systems, instrument clusters—that integrate seamlessly into the vehicle.

This hierarchical structure demands exceptional coordination. When a Tier 1 supplier designs an EV battery management system, they’re not just creating a circuit board—they’re engineering a safety-critical component that must communicate flawlessly with dozens of other systems while operating in extreme temperatures, surviving 15+ years of vibration, and meeting stringent EMI requirements.

The PCB manufacturer sits at the foundation of this pyramid, yet their decisions ripple upward. A supplier who understands automotive-specific design rules for copper thickness, impedance control, and thermal management enables Tier 1 engineers to create more reliable products faster. Conversely, a supplier who treats automotive PCBs like consumer electronics boards introduces risks that manifest as field failures, warranty claims, and safety recalls.

For OEMs and Tier 1s alike, the supplier relationship must be a true engineering partnership. You need a manufacturer who participates in Design for Manufacturing (DFM) reviews, provides early feedback on material selections, and maintains the process controls that ensure batch-to-batch consistency across years of production.

The Seven Critical Selection Criteria

Selecting an automotive PCB supplier requires evaluating capabilities across seven interconnected dimensions. Each criterion addresses specific risks inherent in automotive electronics manufacturing.

1. Quality Management System Maturity

An automotive-grade quality management system goes far beyond basic ISO 9001 compliance. The right supplier demonstrates mature processes for risk management, continuous improvement, and problem-solving. They conduct thorough Failure Mode and Effects Analysis (FMEA) during design reviews, implement Statistical Process Control (SPC) on critical manufacturing parameters, and maintain detailed process control plans.

Look for suppliers who have embedded quality at every manufacturing stage—from incoming material inspection through final electrical testing. The best partners proactively identify potential issues through process monitoring rather than relying solely on end-of-line inspection. When you tour their facility, you should see evidence of visual management systems, clearly documented work instructions, and operators trained in quality principles.

2. Automotive Design and Manufacturing Capabilities

Automotive PCBs demand specialized expertise that consumer electronics manufacturers often lack. Your supplier must understand how automotive-specific requirements—extended temperature ranges (-40°C to 125°C), high vibration resistance, and 15+ year operational lifetimes—affect material selection and manufacturing processes.

Critical capabilities include controlled impedance design for high-speed CAN and Ethernet communications, heavy copper layers (up to 6oz) for power distribution, and blind/buried via technology for high-density designs. For advanced driver assistance systems, your supplier should offer HDI capabilities with 0.05mm/0.05mm trace width and spacing for camera modules and radar sensors.

Equally important is understanding automotive-specific design rules. Automotive boards often require larger annular rings and drill-to-copper clearances than consumer products to ensure reliability under vibration. Your supplier should actively participate in design reviews, flagging potential manufacturability or reliability issues before you commit to production.

3. Industry Standards and Certifications

Automotive electronics operate under the most stringent quality requirements in the PCB industry. The foundation is IATF 16949 certification—the global quality management standard specifically for automotive suppliers. Unlike generic ISO 9001, IATF 16949 includes automotive-specific requirements for process capability studies, measurement system analysis, and production part approval processes (PPAP).

Beyond IATF 16949, verify that your supplier maintains ISO 13485 for medical-grade quality systems if you’re developing health-monitoring or safety systems. AEC-Q100 and AEC-Q200 standards apply to components mounted on boards, but suppliers should demonstrate understanding of these qualification requirements since they affect assembly processes and reliability testing.

Compliance with IPC-6012 Class 3 (highest reliability) for rigid PCBs and IPC-6013 Class 3 for flexible circuits is non-negotiable for safety-critical applications. These standards define acceptability criteria for everything from copper plating thickness to solder mask registration. Additionally, environmental compliance through RoHS and REACH certification ensures your products meet global market requirements.

Don’t just verify that certifications exist—understand how they’re maintained. Ask about internal audit frequencies, nonconformance rates, and corrective action processes. A certificate on the wall means little if the underlying management systems aren’t actively practiced.

4. Traceability and Change Control

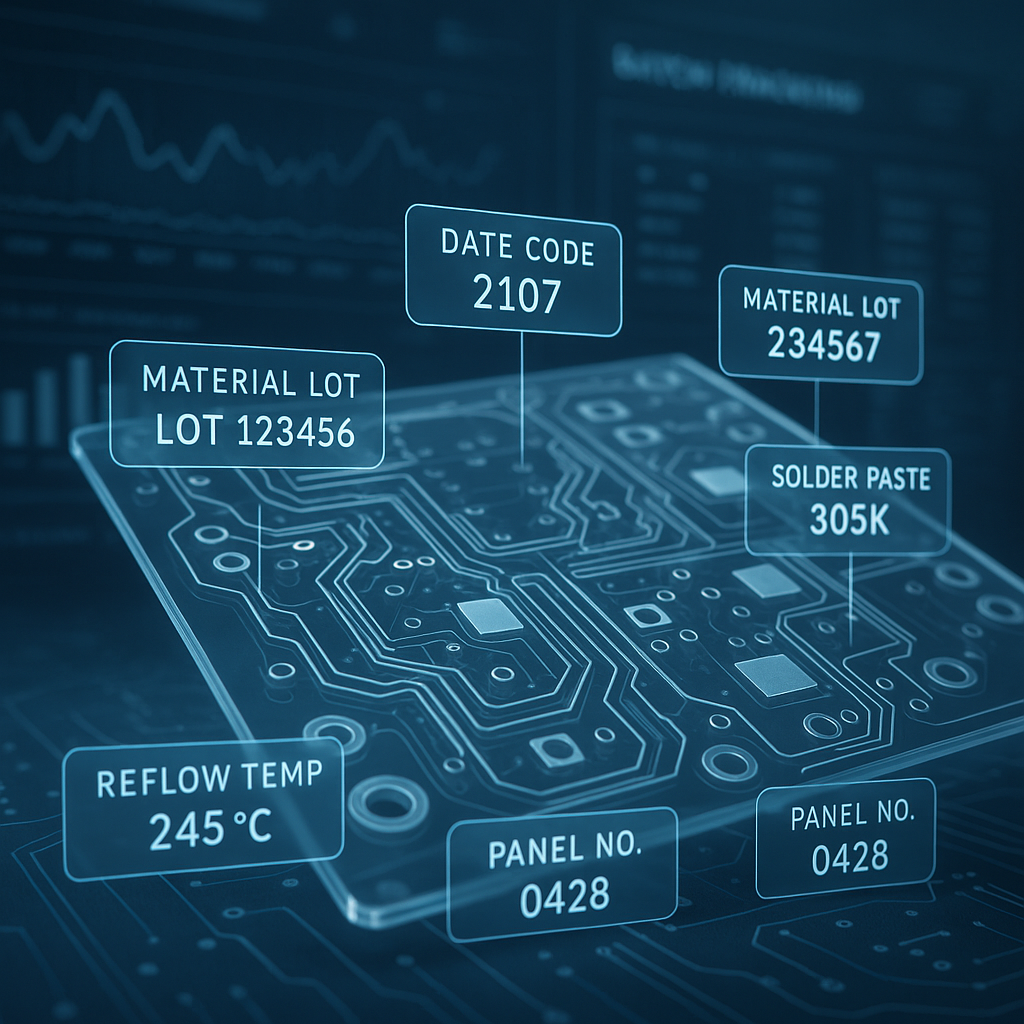

When an automotive recall occurs, you need complete visibility into every board manufactured. World-class suppliers maintain comprehensive traceability systems that link each PCB to its raw material lot numbers, manufacturing date codes, operator IDs, and test results.

This traceability must extend throughout the supply chain. Your supplier should track substrate materials to specific manufacturer lot codes, copper foil to supplier batch numbers, and surface finishes to plating tank parameters. When you request a manufacturing record for boards produced three years ago, they should be able to provide complete documentation within hours.

Equally critical is formal change control. Automotive electronics have long production lifecycles—10 to 15 years isn’t uncommon. Your supplier must notify you of any process changes, material substitutions, or facility modifications through a formal change management system, typically following automotive change request (ACR) processes. They should never implement changes without documented customer approval, and should maintain revision control that ensures older product versions remain reproducible if needed.

5. Manufacturing Quality Capabilities

Process capability directly determines product quality and long-term reliability. Your supplier should demonstrate statistical process control on critical parameters, with Cpk values of 1.33 or higher for key characteristics like copper thickness, hole size, and impedance.

Advanced manufacturing capabilities for automotive applications include:

• Laser direct imaging (LDI) for fine-line circuit definition, ensuring precise trace geometries even at 0.075mm line widths

• Automated optical inspection (AOI) at multiple process stages catches defects before they propagate

• X-ray inspection verifies internal layer alignment and via formation quality

• Impedance testing on 100% of controlled impedance boards ensures signal integrity for high-speed communications

Your supplier’s defect rates tell the story. While consumer electronics manufacturers might operate at 1,000-2,000 ppm defect rates, automotive applications demand levels below 500 ppm—and best-in-class suppliers achieve less than 100 ppm through robust process controls.

6. Reliability and Test Readiness

Automotive electronics must survive harsh environments and deliver consistent performance for 15+ years. Your supplier should maintain comprehensive reliability testing capabilities aligned with automotive standards.

Essential testing includes thermal cycling (-40°C to 125°C, 1,000+ cycles), vibration testing per JESD22-B103, humidity resistance testing (85°C/85% RH for 1,000 hours), and highly accelerated stress testing (HAST). For safety-critical applications, they should conduct microsectioning analysis to verify plated through-hole quality and layer-to-layer registration.

Beyond standard reliability testing, look for suppliers who perform Design of Experiments (DOE) studies to optimize process parameters and can provide process capability data for critical characteristics. They should offer Engineering Sample (ES) and Production Sample (PS) validation support following PPAP requirements, including dimension reports, material certifications, and reliability test reports.

7. Supply Chain Resilience

Recent semiconductor shortages and geopolitical tensions have exposed supply chain vulnerabilities. Your PCB supplier needs robust strategies to ensure continuity of supply.

Evaluate their material sourcing—do they have multiple qualified sources for critical materials like substrate laminates and copper foil? How quickly can they pivot to alternative materials if primary suppliers face disruptions? Their supplier management program should include regular audits of key vendors and contractual agreements ensuring material availability.

Geographic risk diversification matters too. A supplier with manufacturing facilities in multiple regions can shift production if one location faces lockdowns, natural disasters, or trade restrictions. For high-volume automotive programs, dual-source strategies become essential—can your supplier support production transfer to backup facilities while maintaining equivalent quality?

Lead time flexibility is the final consideration. Automotive production schedules change constantly. Your supplier should demonstrate the ability to accelerate deliveries for urgent needs (ideally 3-5 days for emergency orders) while maintaining normal lead times of 7-10 days for standard production. This flexibility requires sophisticated production planning and material inventory management.

Best Practices for Supplier Evaluation

Transitioning from criteria to action, OEMs and Tier 1 manufacturers should implement a structured evaluation process. Begin with a detailed pre-screen questionnaire covering certifications, capabilities, and capacity. Request specific data: average defect rates by board type, on-time delivery percentages, and customer references from similar automotive applications.

Conduct on-site audits of finalist suppliers. Walk the production floor, observing cleanliness, organization, and operator training. Review quality records, examining internal audit findings and customer complaint trends. Interview quality managers about their FMEA processes and how they’ve resolved past issues.

Run pilot production before committing to volume manufacturing. Order 100-500 pieces matching your actual design specifications, then conduct thorough incoming inspection and reliability testing. This pilot reveals how the supplier handles real-world challenges—specification interpretation, material procurement, and quality consistency.

Establish clear performance metrics in your supplier agreement: defect rates (target <100 ppm for automotive), on-time delivery (>95%), and responsiveness to engineering questions (response within 24 hours). Review these metrics quarterly, conducting business reviews that examine trends and improvement initiatives.

Your Supplier Selection Checklist

An ideal automotive PCB supplier demonstrates:

✓ IATF 16949 certification with documented quality management systems and regular audits

✓ Automotive-specific design capabilities including controlled impedance, heavy copper, and HDI technologies

✓ Comprehensive traceability from raw materials through finished boards, maintained for 15+ years

✓ Statistical process control with Cpk >1.33 on critical parameters and defect rates <100 ppm

✓ Reliability testing facilities meeting automotive environmental and mechanical stress standards

✓ Supply chain resilience through multiple material sources and geographic manufacturing options

✓ Engineering partnership approach with proactive DFM feedback and responsive technical support

The relationship between automotive OEMs, Tier 1 suppliers, and PCB manufacturers isn’t transactional—it’s a collaboration that directly impacts vehicle safety, reliability, and market success. Every board that powers an electric vehicle’s battery management system, enables lane-keeping assistance, or processes infotainment data carries the weight of these partnerships.

Selecting the right automotive PCB supplier requires looking beyond price and lead time to evaluate quality systems, technical capabilities, and long-term reliability. The manufacturers who understand automotive-specific requirements, maintain rigorous certifications, and demonstrate supply chain resilience become true partners in your product development journey. When you’re engineering electronics that protect lives and define vehicle performance for 15+ years, supplier selection isn’t just a procurement decision—it’s a strategic choice that shapes your competitive advantage and market reputation.